Property Tax Rate Miami Dade County . The property appraiser's office does not set taxes. Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. Web the office of the property appraiser is continually editing and updating the tax roll. If you live in downtown miami (miami dda), the tax rate is 2.10833%. Web calculate your property taxes in miami by multiplying your home’s market value by 2.06152%. Web one mill represents $1 in tax per $1,000 of property value. Web how are my taxes calculated? By adding up all the millage rates, you get the total millage rate applied. This website may not reflect the most current information on record. The millage rates (also called tax rates) and.

from propertyappraisers.us

If you live in downtown miami (miami dda), the tax rate is 2.10833%. Web calculate your property taxes in miami by multiplying your home’s market value by 2.06152%. This website may not reflect the most current information on record. The property appraiser's office does not set taxes. The millage rates (also called tax rates) and. Web the office of the property appraiser is continually editing and updating the tax roll. Web one mill represents $1 in tax per $1,000 of property value. Web how are my taxes calculated? By adding up all the millage rates, you get the total millage rate applied. Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1.

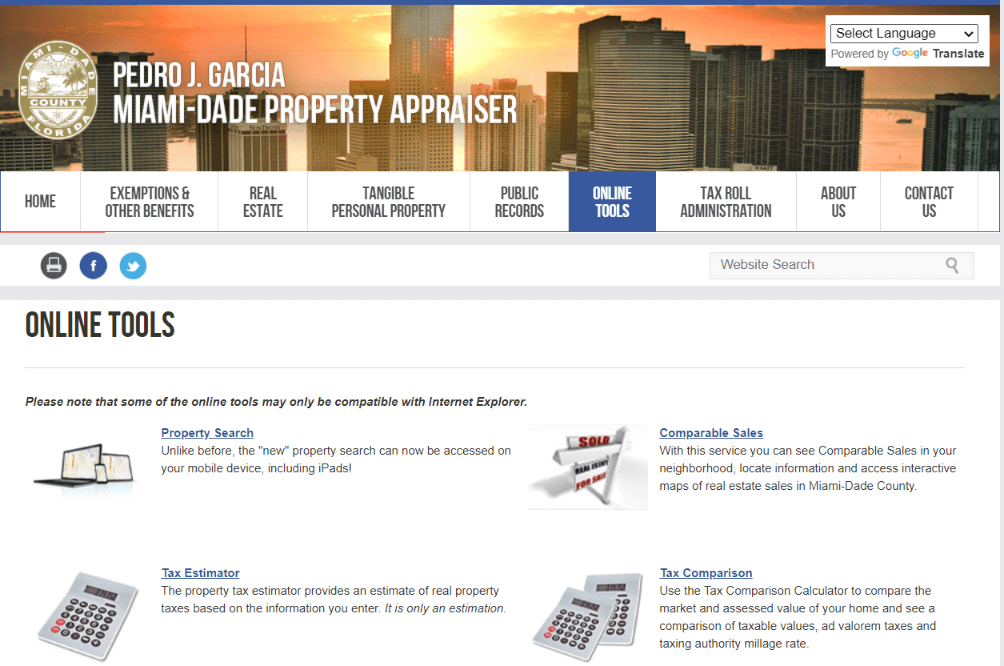

Miami Dade County Property Appraiser How to Check Your Property’s Value

Property Tax Rate Miami Dade County Web one mill represents $1 in tax per $1,000 of property value. By adding up all the millage rates, you get the total millage rate applied. This website may not reflect the most current information on record. Web the office of the property appraiser is continually editing and updating the tax roll. Web how are my taxes calculated? Web calculate your property taxes in miami by multiplying your home’s market value by 2.06152%. Web one mill represents $1 in tax per $1,000 of property value. Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. If you live in downtown miami (miami dda), the tax rate is 2.10833%. The property appraiser's office does not set taxes. The millage rates (also called tax rates) and.

From www.facebook.com

MiamiDade County Government HOW TO pay your property taxes online Property Tax Rate Miami Dade County The millage rates (also called tax rates) and. This website may not reflect the most current information on record. If you live in downtown miami (miami dda), the tax rate is 2.10833%. By adding up all the millage rates, you get the total millage rate applied. Web the real property tax estimator will calculate the ad valorem portion of property. Property Tax Rate Miami Dade County.

From www.kaigi.biz

Dade County Property Appraiser Record Search Property Tax Rate Miami Dade County Web the office of the property appraiser is continually editing and updating the tax roll. Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. By adding up all the millage rates, you get the total millage rate applied. If you live in downtown miami (miami dda),. Property Tax Rate Miami Dade County.

From propertyappraisers.us

Miami Dade County Property Appraiser How to Check Your Property’s Value Property Tax Rate Miami Dade County This website may not reflect the most current information on record. The millage rates (also called tax rates) and. Web one mill represents $1 in tax per $1,000 of property value. By adding up all the millage rates, you get the total millage rate applied. If you live in downtown miami (miami dda), the tax rate is 2.10833%. Web the. Property Tax Rate Miami Dade County.

From sbkass.com

What is the Sales Tax Rate in Miami, Florida 2023 Sales and Use Tax in Property Tax Rate Miami Dade County Web the office of the property appraiser is continually editing and updating the tax roll. By adding up all the millage rates, you get the total millage rate applied. The property appraiser's office does not set taxes. Web how are my taxes calculated? Web one mill represents $1 in tax per $1,000 of property value. Web the real property tax. Property Tax Rate Miami Dade County.

From www.axishelps.org

Axis Helps Miami Miami's Local Business Tax What Every Business Property Tax Rate Miami Dade County The millage rates (also called tax rates) and. Web one mill represents $1 in tax per $1,000 of property value. Web how are my taxes calculated? Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. The property appraiser's office does not set taxes. If you live. Property Tax Rate Miami Dade County.

From propertytaxgov.com

Property Tax Miami Dade 2023 Property Tax Rate Miami Dade County The property appraiser's office does not set taxes. By adding up all the millage rates, you get the total millage rate applied. Web one mill represents $1 in tax per $1,000 of property value. Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. Web how are. Property Tax Rate Miami Dade County.

From www.miamiherald.com

Will your MiamiDade County property taxes go up this year? Miami Herald Property Tax Rate Miami Dade County Web the office of the property appraiser is continually editing and updating the tax roll. Web one mill represents $1 in tax per $1,000 of property value. Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. The property appraiser's office does not set taxes. If you. Property Tax Rate Miami Dade County.

From propertytaxgov.com

Property Tax Miami Dade 2023 Property Tax Rate Miami Dade County Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. Web calculate your property taxes in miami by multiplying your home’s market value by 2.06152%. By adding up all the millage rates, you get the total millage rate applied. The millage rates (also called tax rates) and.. Property Tax Rate Miami Dade County.

From propertytaxgov.com

Property Tax Miami Dade 2023 Property Tax Rate Miami Dade County By adding up all the millage rates, you get the total millage rate applied. Web calculate your property taxes in miami by multiplying your home’s market value by 2.06152%. Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. The property appraiser's office does not set taxes.. Property Tax Rate Miami Dade County.

From lipost.co

Map of MiamiDade Property Value Growth in 2023 Long Island Post Property Tax Rate Miami Dade County Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. Web the office of the property appraiser is continually editing and updating the tax roll. Web how are my taxes calculated? This website may not reflect the most current information on record. Web one mill represents $1. Property Tax Rate Miami Dade County.

From propertyappraisers.us

Miami Dade County Property Appraiser How to Check Your Property’s Value Property Tax Rate Miami Dade County Web the office of the property appraiser is continually editing and updating the tax roll. Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. Web how are my taxes calculated? The property appraiser's office does not set taxes. The millage rates (also called tax rates) and.. Property Tax Rate Miami Dade County.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Property Tax Rate Miami Dade County By adding up all the millage rates, you get the total millage rate applied. Web how are my taxes calculated? Web calculate your property taxes in miami by multiplying your home’s market value by 2.06152%. Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. Web one. Property Tax Rate Miami Dade County.

From www.hawkinscre.com

Millage Rates in MiamiDade County by Municipality, Sorted from High to Property Tax Rate Miami Dade County The property appraiser's office does not set taxes. Web calculate your property taxes in miami by multiplying your home’s market value by 2.06152%. Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. The millage rates (also called tax rates) and. Web the office of the property. Property Tax Rate Miami Dade County.

From www.booksandbalancesinc.com

MiamiDade County Taxes What's New for the Latest Tax Year Property Tax Rate Miami Dade County Web the office of the property appraiser is continually editing and updating the tax roll. The property appraiser's office does not set taxes. The millage rates (also called tax rates) and. Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. By adding up all the millage. Property Tax Rate Miami Dade County.

From www.hauseit.com

How to Find Your Florida Property Tax Number, Folio or Parcel ID Number Property Tax Rate Miami Dade County Web calculate your property taxes in miami by multiplying your home’s market value by 2.06152%. Web how are my taxes calculated? The millage rates (also called tax rates) and. Web one mill represents $1 in tax per $1,000 of property value. By adding up all the millage rates, you get the total millage rate applied. The property appraiser's office does. Property Tax Rate Miami Dade County.

From www.miamiherald.com

In MiamiDade, schools command top tax rate Miami Herald Miami Herald Property Tax Rate Miami Dade County Web calculate your property taxes in miami by multiplying your home’s market value by 2.06152%. The property appraiser's office does not set taxes. Web one mill represents $1 in tax per $1,000 of property value. The millage rates (also called tax rates) and. If you live in downtown miami (miami dda), the tax rate is 2.10833%. This website may not. Property Tax Rate Miami Dade County.

From propertyappraisers.us

Miami Dade County Property Appraiser How to Check Your Property’s Value Property Tax Rate Miami Dade County By adding up all the millage rates, you get the total millage rate applied. Web the office of the property appraiser is continually editing and updating the tax roll. Web the real property tax estimator will calculate the ad valorem portion of property taxes by multiplying the amount entered in step 1. Web calculate your property taxes in miami by. Property Tax Rate Miami Dade County.

From www.miamiherald.com

MiamiDade GOP says to vote ‘NO’ on school property tax hike Miami Herald Property Tax Rate Miami Dade County Web the office of the property appraiser is continually editing and updating the tax roll. The property appraiser's office does not set taxes. Web one mill represents $1 in tax per $1,000 of property value. The millage rates (also called tax rates) and. By adding up all the millage rates, you get the total millage rate applied. Web the real. Property Tax Rate Miami Dade County.